Showing results for "#GST Council"

Rs 1.51 lakh crore of GST evasion detected in April-October,...

The tax authorities have issued 71 notices to online gaming companies for not paying GST of Rs 1.12 lakh crore in financial years 2022-23 and 2023-24,...

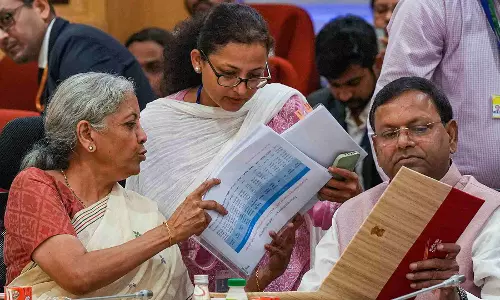

Status quo: 28 pc GST on online gaming stays for now

3 Aug 2023 1:30 AMThe new levy, subject to review in six months post roll out, is likely to come into effect from October 1

TN registers strong reservation to GST proposals for online...

2 Aug 2023 5:10 PMThennarasu also insisted that the modification suggested should be incorporated in the proposed amendments of the Act.

Gaming industry proposes new GST levy formula to government

28 July 2023 5:00 PMThe decision has come as a rude shock for the gaming industry, which, in an open letter to the government, has urged it to reconsider the decision.

GST Council agrees to levy 28% tax on online gaming on full face value

11 July 2023 3:50 PM28 per cent tax would be levied on the full face value of bets, Mungantiwar said.

GST council likely to discuss taxation under ONDC during meeting next...

9 July 2023 11:34 AMThis has led to confusion among authorities as to which of these entities should be taxed, due to multiple agencies involved.

Reduce GST on 2-wheelers to 18%, says FADA

19 May 2023 2:33 AMThis intervention is aimed at making two-wheelers more affordable, reviving demand and reinvigorating an industry that has seen a significant slump in...

No rate hike, GST Council votes for uniform lottery rate

18 Dec 2019 3:28 PMThe all-powerful GST Council, in its 38th meeting here on Wednesday, voted for uniform rate of 28 per cent on lotteries across the country.